In last week’s post, I mentioned, I was going to talk about my new investment and here I am disclosing it.

Silver: More than just a pretty face.

I was planning to invest in Silver from 2020-2021 when I first read that its demand would increase as it would be used in 5G technology. For one or the other reason, I kept on delaying the investment until this week when I took a position in the Silver.

My study shows that the demand for silver will continue to grow and the price will eventually catch up. Here are a few reasons why the demand for silver will increase.

Reasons for the increase in Silver demand

Reason 1: Silver's Role in 5G Technology

I have been studying silver role in 5G for years now. Silver's exceptional properties, including its high electrical conductivity, thermal conductivity, and antibacterial qualities, make it an indispensable material in various industries, including electronics and telecommunications. It finds application in Printed Circuit Boards, 5G Antennas, and RF (Radio Frequency) Components.

Here are the demand numbers: The widespread deployment of 5G networks is expected to increase the demand for silver significantly. According to the Silver Institute, silver demand for 5G applications is projected to rise from approximately 7.5 million ounces in 2020 to 16 million ounces by 2025 and 23 million ounces by 2030.

Reason 2: Electric Vehicles

For the past couple of years, I have been reading about EVs, and somewhere or another, silver has been mentioned. One of the biggest problems with EVs is the high charging time and silver may solve this problem. Silver is used in the production of silver-zinc batteries, which offer high energy density and fast charging capabilities. These batteries are being explored as a potential alternative to lithium-ion batteries in EVs.

If the research goes through, can you make a guess how much silver would be needed? According to industry estimates, the demand for silver from the automotive sector is projected to grow by 170% by 2030. This growth is fueled by the increasing adoption of EVs and the growing number of electronic components used in these vehicles.

Silver 3: Solar Panels/Renewable Energy

In the earlier post, I covered renewable energy. During my study, while studying at a solar company, I figured silver is needed in solar panels. Its unique properties make it an indispensable component in the photovoltaic (PV) cells that convert sunlight into electricity. I could not wait to take a position in silver.

According to the Silver Institute, the solar industry accounted for approximately 140 million ounces of silver demand in 2022. This figure is expected to grow substantially in the coming years as the world transitions to cleaner energy sources.

Did you notice - even though I am discussing investment in silver, many more investment themes have been covered?

Next, before taking position, the only thing I wanted to check was returns.

Understanding Price

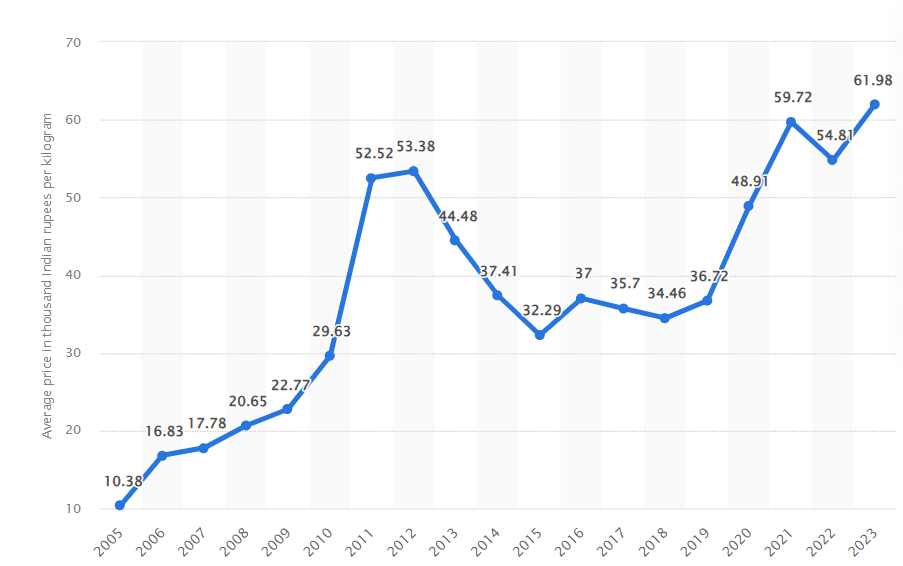

Average price of silver in India from 2005 to 2023 - (in 1,000 Indian rupees per kilogram)

Here are a few things to note from the above price chart:

There was a sharp increase in silver prices between 2008 and 2012 - 2.5X growth.

Between 2012 and 2020, the net return was zero.

Since 2020, the price has increased by 15%.

My Views

In the last 12 years, the silver price has increased by only 20%.

Given all the demand projected for silver, even if half of it is true, the prices are bound to increase - soon.

Why am I investing now?

I could have invested in the silver in 2021 at more or less the same price. Three years later, the same price, makes silver even more compelling to invest in.

Secondly, I believe there is a minimal downside to this asset class from the current levels. At maximum, a 5% fall, and it may zoom 20% in no time for current levels (recent high).

I have always tried to have some stocks in my portfolio with minimum downside. These investments are generally considered to have a low risk of capital erosion, meaning I have a lower chance of losing a substantial portion of the initial investment.

My Investment Strategy

I don't plan to invest in SIP mode for this which I usually prefer for stocks. I will make a lumpsum investment - probably in 2 more shots.

I already bought one more lot this week.

From Previous Post

On CreditAccess Grameen, so here is how things turned out for me. Please read the previous post then only the remaining part will make sense to you.

I invested 1/3 of the capital I wished to invest in the company by looking at the numbers, industry, and growth projection. However, in the initial analysis, I failed to look at promoters planning to exit.

For now, a big question mark remains on the company's future. But not on the business. If the management change happens smoothly and as planned, I am 100% going to revisit the company. For now, I exited all the positions.

Learning for readers: Learn to accept your mistake and correct it immediately. I may still be wrong and stock may give up a good run-up from the current levels but based on all the points, I discussed, at this moment, I prefer to stay away.

If you have liked this post and for more such posts, please subscribe to the newsletter.

See you next week with an interesting story and good learning.

Nice article Abhinav. I like the way you explain it. Keep it up

Excellent article Abhinav! Even I wanted to invest in silver but not through silverbees. Do you know other option to invest in silver?