I have been studying and covering SME IPOs for a while now. I know people who help SMEs to get listed. Also, have a few friends from the SME world. Here is the plan.

A college friend runs a family business. When I met him last, he told me his business generates a revenue of Rs 5 crore annually. I asked him why he was not considering getting his business listed as SME.

“You can make excellent profits and running a listed business is a different feeling,” I told him.

He was interested in knowing more. I told him the plan.

“See, ideally, your business should be valued at 5x and best case scenario at 10x of your annual revenue. It means somewhere between 25 crore and 50 crore. But I know of people/bankers who will project your business at Rs 100 crore valuation and also ensure the IPO gets fully subscribed.”

“This is awesome.” He was elated. “Tell me more.”

“At a Rs 50 crore valuation, if you would have sold a 10% stake, you would have made 5 crore from the listing. Now, with 100 crore, you can make 20 crore. The bankers will take Rs X crore. And obviously, I will get a cut from them as I introduce you to them.”

“How much money will you make?”

“Not much - Rs 50 lakh.”

This is how I made Rs 50 lakh from SME IPO.

Before you get too excited about the money and send congratulations messages - here is the thing.

‘I’ here is a fictional character but the story is true.

Many SME IPOs have been listed in the same way in recent months. Reports are suggesting that and even the insiders and some news media houses/experts have communicated the same.

Many IPO companies are coming into the market following the same model. The bankers and middlemen are reaching companies and asking them to get listed through this process. Would you want to be the owner of such a company?

Here is a hard-hitting number - Rs 14,000 crore has been raised through the SME platform of stock exchanges over the past decade and nearly 43% of it (Rs 6,000 crore) was raised in FY24 alone. What has changed in FY24?

Some questions for investors to think about:

Why is every company rushing to get listed as an SME?

How come every SME IPO gets subscribed 100-500 times?

Excellent Businesses or Pretty Good Marketing?

Why SME IPOs are getting so much coverage? There was hardly any coverage in 2023 and 2022.

Many of these companies don’t even have a registered office, what are people investing in?

Astonishing Numbers

SME IPOs with the highest subscriptions

SME IPOs with the highest gains

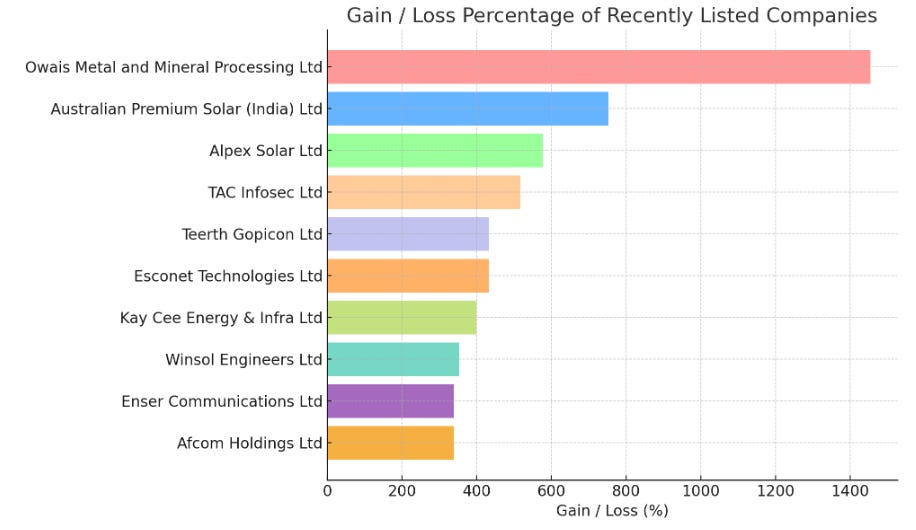

Here is a bar chart representing the gain/loss percentages of the recently listed companies. It clearly shows that Owais Metal and Mineral Processing Ltd has the highest gain at 1453.79%, followed by Australian Premium Solar (India) Ltd at 752.78%. The rest of the companies are sorted in descending order based on their performance.

100-500-1000-2000x subscription levels for retail investors? Who are these investors, investing in these companies? A few years back, retail investors were not this crazy. Yes, we are in one of the best bull runs, but still, someone needs to answer - why sudden jump?

In 2023, the highest subscription in the retail segment was 1060x, and only 2 companies have more than 1000x subscriptions.

In 2022, the highest subscription in the retail segment was 680x and only 3 companies got more than 400x subscriptions.

I don’t want to discourage investors or have anything against SME IPOs. If you are investing in an SME because a broker is talking about it or news channels are covering it - please don’t do it. At least know the business, check the financials, industry, etc.

If you cannot do it, let it go. Or put the company name in the comment and I will reply to your comment with essential details so you can decide.

Are all SME IPOs not worth an investment?

No, there are a few diamonds in the coal mine. And as I said, I am not against them. In fact, I have subscribed to Sahasra Electronics Solutions IPO. I am not going to share the reasons. But if you have any specific questions about it, please ask me in the comments. I will be more than happy to answer.

In the next post, I will share:

Was I allotted shares or not?

If yes, what are my plans - hold, buy, or sell?

If not, will I buy from the open market?

Request from SEBI

SEBI should come into action, sooner rather than later. Companies like Resourceful Automobile (2 Yamaha dealership), Broach Lifecare Hospital (two branches with only 40 beds), Kody Technolab (market cap of Rs 2185 crore on profit of Rs 4 crore), TGIF Agribusiness (company discloses no other information about its financials, besides the headline numbers) should not be in the listed space.

The only reason investors are still safe is because we are in a bull run. The tide can change directions at any time.

Some Insight from an Expert on SME IPO

I shared my views on the SME IPO and I wanted to share views and some explanation on SME IPO who is from the industry, Adv Abhishek Khare, Founder and Managing Partner of Khare Legal Chambers LLP. He is a Securities Law Expert.

Q1) Abhishek, what is your overall take on the SME IPOs?

Ans) There indeed are a lot of expansion and capital growth opportunities. These offerings can prove a little risky due to the track records of many SMEs, oversubscription, and limited investment opportunities.

Q2) Can you explain the role of merchant bankers in the SME IPO Listing?

Ans ) Merchant Banker acts as an intermediary their roles are – Portfolio Management, Due Diligence (organizing and gathering necessary documents), Drafting of Prospectus/Contracts, Underwriting, and Post issuance formalities.

Q3) Is the success of SME IPOs all about marketing as we hear?

Ans) It does not solely depend on Marketing. Marketing is one of the essentials but can only be executed when the company has done all the essentials such as Company valuation, Unique Business Models, and Company Investor Relations. Once the Company has been evaluated and is going through these stages then Marketing helps to increase the reach and propose business models.

Q4) What according to you would be the future of the Indian SME IPO market in few years?

Ans) Indian SME IPOs seem to be very promising in the coming years as they have been demonstrating profitability to achieve higher valuations. Banks(favorable equity markets and debt support), Promoters(aiming for profitability), and Government Incentives (tax benefits, export subsidies) along with Technological Improvements enhance and motivate SME Markets to flourish.