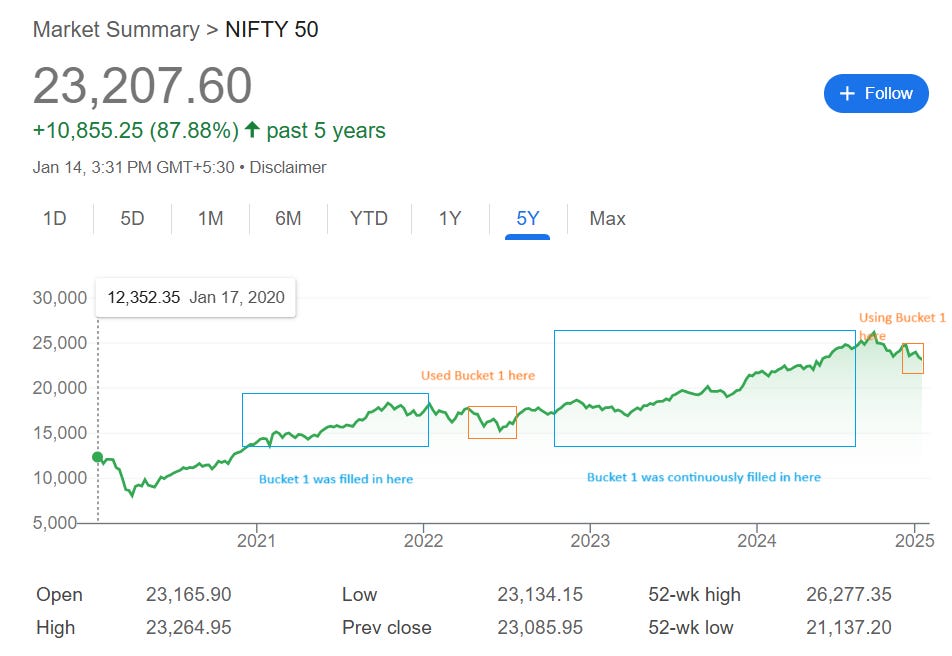

The markets are down more than 10% from their all-time high and recent peak and I have not been writing for a while, so I thought it is right time to connect with the subscribers.

Still not subscribed? Please subscribe now. Lack of motivation kept me away

Nifty50 is down 11% but your portfolio/individual stocks may be down 15-20%. I recently did a poll and asked the investor community if they have enough money to invest in this market. To be honest, to generate alpha for your portfolio, you need to invest at this time.

The majority said they don’t have enough money at this time. So, I thought to share how I manage my investments, so others can implement and benefit. Don’t expect some out-of-the-box suggestions. My investing plans are very simple and basic - the key to success will be on the implementation as a large percentage won’t be able to implement it.

Let me get started.

How do I invest in the stock market?

My rule is simple. Assume I can invest Rs 100 per month in the stock market. But I never invest Rs 100 monthly. I only invest Rs 80 through SIP (in mutual funds and ETFs) and direct equity purchases. The remaining goes to two buckets.

Bucket 1: This bucket will have Rs 15 and I keep this in a different bank account. This amount keeps accumulating every month and I have turned on Flexi Fixed Deposit Option which means that I get around 7% on this amount.

Bucket 2: The remaining Rs 5 goes to a different bucket, which I usually put in proper FDs twice a year. My bucket 2 also includes an investment in a debt fund which I did in 2021 as lumpsum (only one time). Another will happen sometime in 2025.

How do I use these buckets?

Bucket 1 is only touched when the market falls more than 10%. It is not a hard and fast number but somewhere there. So, since December 2024, I have been taking out money from my bucket 1. Before this, the last I used my bucket was in mid-2022, when the market fell to 15000 levels from 18000. Since then, I am only putting money in this bucket. No point in guessing, there is decent money to invest.

Here is a secret - You can see a gap between orange and blue boxes. These are times when I was deploying Rs 95 to the market. It is the time when the market is already down 5-6-7%. If you see a good buying opportunity, deploy all your monthly investment because you never know when the market will bottom out.

Bucket 2 is only for real market crashes - a fall of 20% or more. Again 20% is not locked, I may withdraw it partially at 15% and the balance at 20%. I have not used this bucket yet. (this bucket was not in the 2020 Covid Crash).

To Sum up,

Invest 80% of your potential when market is going up, deploy 95% of your potential when markets have fallen 5% or more and start withdrawing from buckets as market falls considerably.

The Discipline Game

Only those become winners in investing who can play the discipline game well. I told you my strategy and implementing it is no big deal. Anyone and everyone can copy and implement the plan.

The key is continuing to do it for months and years. For more than 18 months I did not touch my bucket 1 funds. Can you do it? You have to plan your financials so well that using bucket 1 funds should never become necessity. It should exist for you unless the market falls by 8 to 10%.

If you need help from me around the strategy, please reach out to me at abcofinvesting@gmail.com. If you have any questions about the strategy, put them in the comments.

I HAVE MADE NEW INVESTMENTS (3 NEW STOCKS TO PORTFOLIO) IN THE LAST 6 TO 8 WEEKS AND WILL DISCUSS THE NAMES AND RATIONALE BEHIND THE INVESTMENT IN THE NEXT POST. PLEASE SUBSCRIBE SO YOU DON’T MISS.

If you liked the writeup and want me to continue writing, please share it with your friends

About me - In the last few years, I have noticed that many investors struggle with basic investment concepts. To address this, I have started a personalized newsletter offering easy-to-understand, actionable insights to help investors make better decisions. I have written over 5000+ financial blogs and want to share my knowledge and investing journey with you so you can become a confident investor. Join my journey. SUBSCRIBE NOW.