Seven, you already know. The eighth is compounding, and the 9th is a Systematic Withdrawal Plan.

Recently, a friend reached out to me. His wife planned to leave her job, and she had a corpus to invest. The requirement was to generate a regular income, so she continued to be financially independent. The options with her were:

Fixed Income Options like Fixed Deposits: The interest is not high enough to cover the monthly needs, and if start withdrawing the principal, the money will deplete very fast.

Life Long Income Options like Annuities: You get income for life, but the return is between 5-6%. Again, may not be enough.

Systematic Withdrawal Plan (SWP)

The stock name from previous post is mentioned at the bottom.

I am sharing this story with everyone because of the high use case. Corporate life is tough, and not everyone may want to continue working till 60. There could be N reason for one partner may want to retire early.

SWP gives you the freedom to be financially independent.

So, this post is for everyone in their 20s, 30s, and 40s. Young readers can plan this path, while those in their late 30s or 40s can implement it.

The concept of SWP is simple - you have a corpus and you make monthly withdrawals. Simple, right? But there is a magic that happens in this process. Let us explain through Nisha's example (friend's wife).

Nisha is 40 and she has accumulated 50 lakhs. Her requirement is simple - She wants to draw only Rs 25,000 from January 2025 to manage her expenses. My friend continues to work on their other family goals. In this case, most of you may use, a SWP calculator which is not the right thing to do.

Why?

She needs 25K in 2025 but with inflation, she may need Rs 40K in 2030. So, the SWP calculator gives a wrong or unrealistic picture.

This example is also a perfect example that using any random calculator information available online without understanding the basics can lead you to deep trouble.

This is how I walked her through it (obviously. asked her to consult a financial advisor also).

Assuming 6%, I told Nisha her expenses would gradually increase. The calculation would be super complicated if we consider yearly inflation. So, we used a 5-year time frame.

Between 2025 and 2030 - She would need Rs 25,000

Between 2030 and 2035 - She would need Rs 35,000

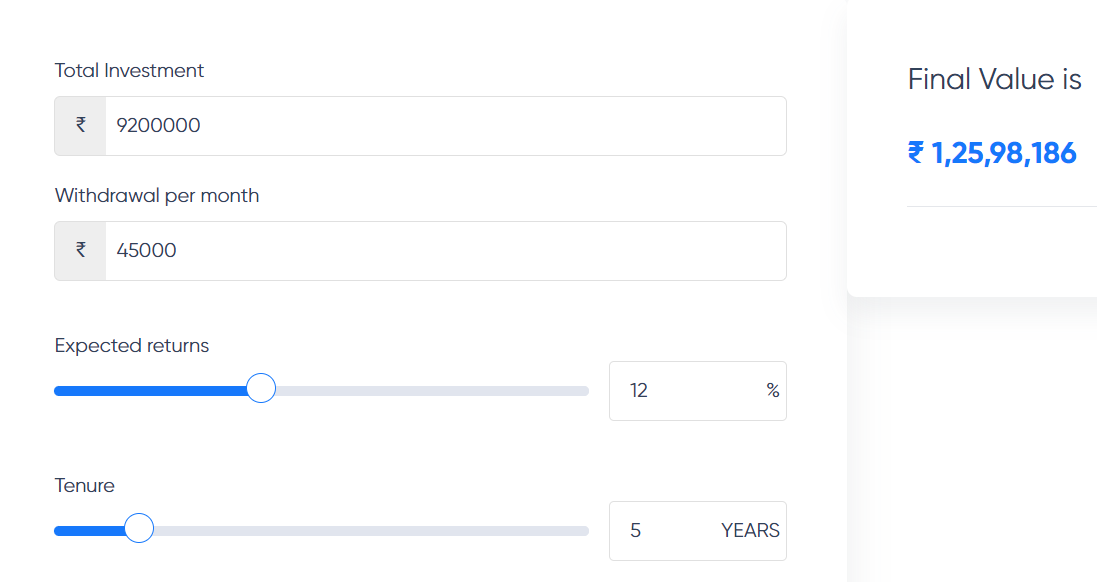

Between 2035 and 2040 - She would need Rs 45,000

and so on

Let us divide the SWP calculator now.

Now, she invested Rs 50,00,000 in different mutual funds and we assumed 12% returns because Nisha can take a slight risk on her investment. She has a fall-back plan.

After the first 5 years, this is what it looks like.

Now taking, 68 lakh as base for next 5 years and withdrawal per month as 35,000. The picture for her in 2035 would be.

In 2040,

Let us say, by 55 (2040), my friend also decides to retire and Nisha may want to withdraw more to take care of additional expenses. Let us assume, she decided to withdraw Rs 75,000.

This is how things will be for her after withdrawing Rs 75,000 for 5 years:

She withdraws Rs 1 lakh for the next 5 years. Here is how it looks:

If you could see the magic happening on the right side of the image, my job for this post is done. It is wonderful. Every time I see these numbers, my energy level goes to a different level. You can start with Rs 50,00,000. Withdraw money for years and still end up having Rs 2 crore (which won’t be much in 20 years but still decent amount).

Let me know your feelings in the comments.

For more such content, subscribe to the newsletter. Next Friday, its ‘Stock Analysis’ from an interesting sector.

P.S: The calculation shown above is a simplified version of the real world. The important thing is to take a message from the post.

Share with your family and friends.

Gaming Sector Stock is Nazara Tech (do your own research on it)

Wasn’t aware of how beneficial SWP can really be!