In the first blog, I mentioned I want to increase the stock count in my portfolio. I am looking for some good stocks. I recently came across - CreditAccess Grameen (Village - hope, you get the title now :) ).

I recently analyzed the stock and this week I thought I should share my findings with the readers. The idea is to tell you how to check a company - effort required, parameters to check, etc. It is not a recommendation in any way. The takeaway is not the company name but how to analyze the company.

About the company

CreditAccess Grameen is registered with the RBI as a non-deposit-accepting NBFC—microfinance Institution (MFI). It uses its distribution channel to offer its members other financial products and services.

Why am I interested in the company?

Here are some reasons related to their business which made me interested in the company:

Community-Based Lending: The company employs a community-based lending model, empowering local communities to identify and support their members' financial needs. This is an interesting point. If you are interested in the company, explore more of this point.

Group Lending: CreditAccess Grameen utilizes group lending, where individuals form self-help groups and collectively guarantee each other's loans. One more masterstroke. I am not sure if other MFIs are doing it or not. But, per my understanding, this signals why the company maintained relatively lower NPAs even in microfinancing.

Financial Literacy: The company places a strong emphasis on financial literacy, educating borrowers about financial concepts and responsible money management.

Technology Adoption: The company has embraced technology to improve efficiency and reach a wider customer base.

The second parameter that I look at is the sector. The microfinance sector has witnessed tremendous growth and development in recent years, driven by the increasing demand for financial services among the rural and underserved population. As we know, India has a vast rural population with limited access to traditional banking services. Any business that can meet the needs of the rural population will grow exponentially.

Industry Numbers

As per data shared by Microfinance Industry Network (MFIN), the AUM of the microfinance industry (MFI) has increased by 22.8% compared to June 30, 2023, and decreased slightly by 0.8% compared to March 31, 2024.

The loan amount of Rs 26,223 crore was disbursed in Q1 FY24-25 through 56.8 lakh accounts, including the disbursement of owned and managed portfolios.

In June 2024, MFIN data said that the microfinance loan portfolio of lenders rose by 24.5% year-on-year (Y-o-Y) in 2023-24 to Rs 4,33,697 crore.

Company’s Financial Numbers

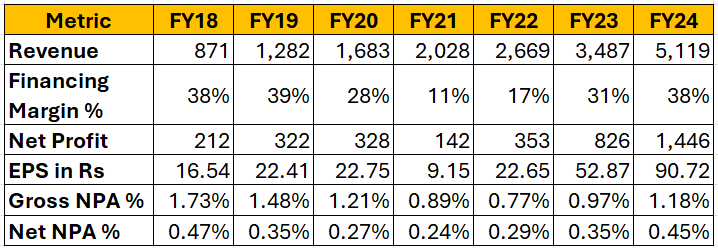

Below is a table I created for you to check the financial numbers quickly. I don’t see any red alerts here.

Financing Margin - It is the difference between the interest income generated from lending and the cost of funds used to finance those loans. A higher financing margin suggests better profitability and financial health of the NBFC.

Here are more crucial numbers:

Key Highlights for me from the above numbers are:

Excellent profit numbers in the last two financial years.

Improving financing margin

Excellent ROE and sales growth in the last 10 years

For the June quarter, promoter, DII, and FII holding combined is 93.69% with DII and FII holding over 25% - excellent numbers for me.

Concerns I see

Management Change - Major reason for the fall in share price

CreditAccess Grameen Limited (CAGL) promoter is CreditAccess India B.V., a Dutch-based multinational company that specializes in micro and small enterprise financing. Now the promoters want to exit the business.

CAGL has over a decade of association with CAI (CreditAccess India) as it is a majority stakeholder. It holds a 66% stake in the company. It has received need-based capital from CAI, which has allowed the company to maintain a growth momentum while maintaining adequate cushion to absorb risks.

Now, the news of a potential exit of CAI is also weighing down the stock’s performance. I am going to closely monitor the development. My understanding is that it could turn out to be positive or negative.

Increasing NPA

The company did exceptionally well to reduce its NPA numbers starting FY18. However, in FY24, the numbers have increased and I would closely track these numbers in the coming quarters.

Regulatory Challenges

Earlier this year, RBI Deputy Governor M Rajeshwar Rao came down heavily on MFIs for charging higher rates to borrowers, thus cautioning against irresponsible practices. He expressed concern over some MFIs disproportionately increasing their margins under the new regime, warning that misuse of regulatory freedom would prompt regulatory action. The RBI has imposed interest rate caps on microfinance loans, which can limit the profitability of MFIs. However, these caps are also intended to protect borrowers from excessive interest rates.

Goldman Sachs on CreditAccess Grameen

Goldman Sachs estimates the total addressable market (TAM) to have expanded by around 50% to $136 billion by the financial year 2025 (FY25).

CreditAccess Grameen is well-positioned to capitalize on this growth, with forecasted assets under management (AUM) growth of 19% over the financial year 2024-2028 estimate (FY24-28E).

Goldman Sachs forecasts a robust 21% compound annual growth rate (CAGR) in profit after tax (PAT) over FY24-26E, driven by continued loan growth and operational efficiencies.

The report was published in April 2024

What did I do to address my above concern?

For Q1FY25, the numbers were not great but in line with the estimates. In July end, the company had a concall post its Q1FY25 numbers. The MD answered the questions about the concerns related to business and industry. Sharing the key points from the 20 pages document (the points are from management POV):

The overall portfolio declined on a sequential basis, in line with internal estimates, given the seasonally weaker business momentum in the first quarter coupled with the general elections. They had factored this in its annual guidance of 23% to 24% portfolio growth in FY25, estimating a lower growth of 20% in the Group Loan business as against 24.7% growth in FY24.

The portfolio yield at 21% continues to remain the lowest in the microfinance industry resonating with our belief in serving customers with responsible pricing.

On the other hand, the cost of borrowing was also stable at 9.8% despite the tightening liquidity scenario in the banking system.

Coming to asset quality, we saw a transitory increase in delinquency trend during the first quarter due to

Low base impact on account of a 1.5% QoQ reduction in the loan portfolio

Extended impact of low rainfall during last year followed by a severe heat wave across several regions throughout the quarter

Operational limitations during general elections, which impacted regular collections and follow-ups in the delinquent buckets considering the sensitivity of the elections with the borrower's profile.

Closing Remark

Let me know your take on the company in the comments (do more research and share points I have not covered).

Do you want to know if I invested in the company or not? I will reveal the answer in the next post (it is an interesting answer believe me and a great learning for new and not-so-new investors!).

Subscribe and don’t miss the upcoming posts.

You can also join my referral program, by referring your friends, you get a chance to have a one-on-one session with me or get a copy of my book - ABC of Investing.

In the next post, I will cover my new investment - NOT A STOCK or MUTUAL FUND.

Just a few months back I read MF houses stocking up CreditAccess and Fusion Micro Finance. Even Fusion Micro Finance has encountered same issues but more intensified.

That was quite insightful! Wanted to know how CAI's (promoter) potential exit can be positive?