I received a message from Sandeep on my Substack profile. He is a young investor and said that he was told by his friend to invest in a new NFO (New Fund Offer). Since he was a close friend Sandeep invested Rs 50,000 in the NFO without questioning.

The problem was that, later, when we tried reading about the fund and category, hardly any data/content/explanation was available. He reached out to me to explain what he had invested in.

Sandeep invested in the Business Cycle Fund by Motilal Oswal. Unlike large, mid, and small-cap mutual funds, these are not much discussed. I decided to invest my time writing on the business cycle fund for Sandeep and many like him.

What are Business Cycle Funds?

Have you ever been on a roller coaster ride? Sometimes, the ride goes up, and sometimes it goes down. The stock market is a lot like that rollercoaster. When the market goes up, it's called a bull market. When it goes down, it's called a bear market.

Similarly, the economy goes through cycles that include different stages like growth (expansion), slowdown (contraction), and recovery. These stages impact businesses differently. Some industries do better in a growth phase (like technology), while others might do better in a downturn (like utilities).

How Does a Business Cycle Fund Work?

Unlike regular mutual funds, which might invest in a broad range of stocks, a Business Cycle Fund changes its investment strategy depending on where the economy is in the cycle:

During economic expansion, it might invest in growth-oriented sectors like tech or consumer goods.

During a recession or slowdown, it might focus on safer sectors like healthcare or energy.

This approach allows the fund to adapt to changing economic conditions to potentially maximize returns or reduce risk.

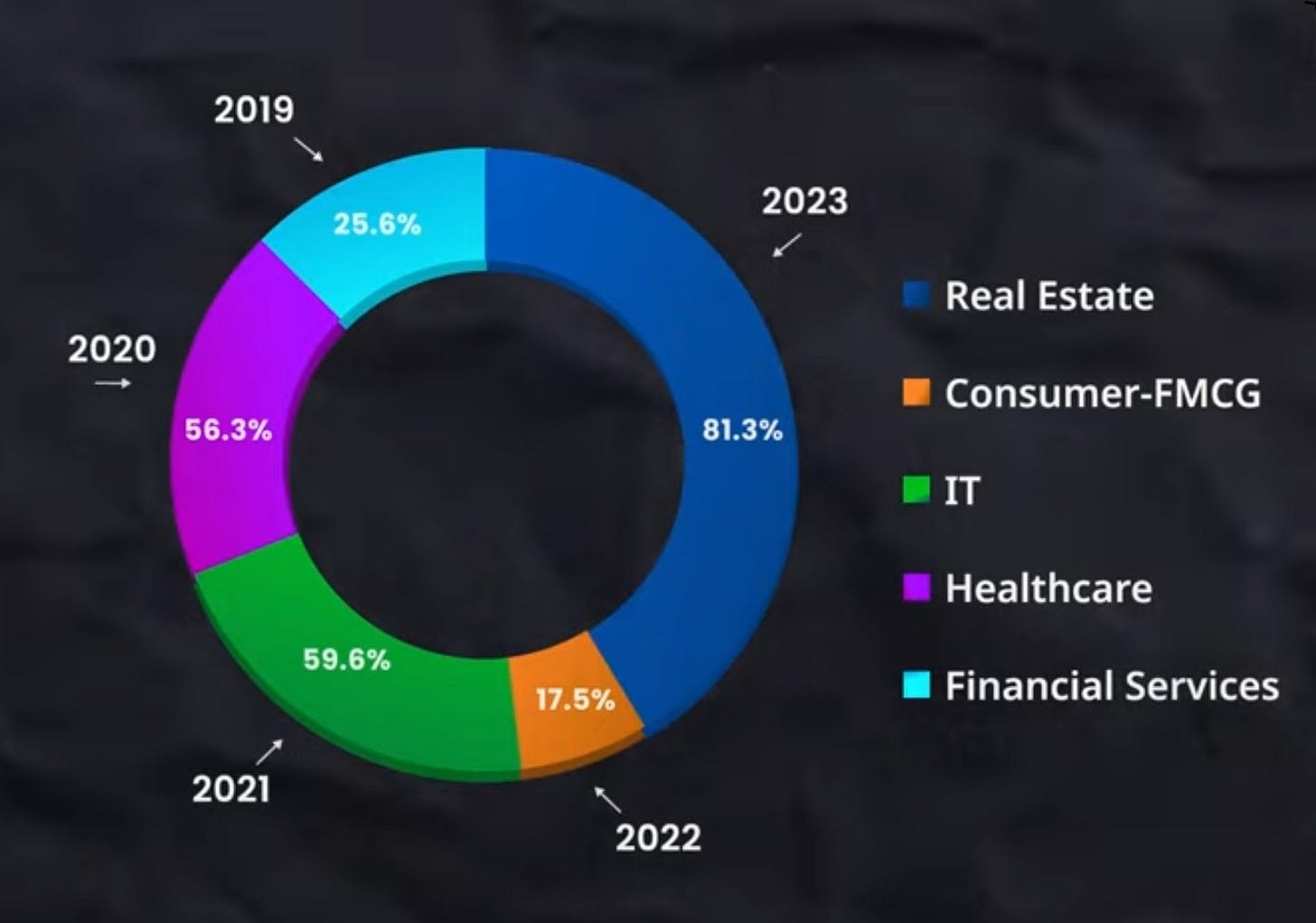

Let me explain through an example. In the below graph, you can see that Financial Services outperformed the Sensex/Nifty in 2019, it was Healthcare in 2020, IT in 2021, and Real Estate in 2023. Every year, as you can see, the STAR performer is different. Now, if you can invest in each of these sectors before the rally starts, you will make higher returns, right? This is what business cycle funds plan to achieve.

How is it Different from Other Funds?

Flexibility: Unlike regular funds, a business cycle fund actively changes its strategy to match the economy, rather than staying static.

Targeted Sectors: It is not invested in all industries equally. The focus changes depending on what’s performing well in that particular economic phase.

Business Cycle Fund by Motilal Oswal - Details

The below is my analysis of the fund. I am not an expert on the same.

Investment Strategy

The fund is actively managed and focuses on long-term capital appreciation through investments in equities and equity-related securities. The fund aims to capitalize on business cycles by strategically allocating investments across various sectors and stocks at different stages of the cycle.

Understanding Business Cycles

Business cycles are cyclical economic fluctuations characterized by periods of expansion and contraction. These cycles vary in terms of duration and intensity.

Investment Approach

The fund will identify and invest in leading sectors that are expected to outperform the broader market during specific stages of the business cycle. This sector-focused approach may lead to temporary absences from certain sectors.

The portfolio construction will combine a top-down approach, analyzing macroeconomic trends and identifying promising sectors, with a bottom-up approach, selecting individual companies within those sectors based on their quality, growth potential, and valuation.

Investment Philosophy

The fund adheres to the QGLP (Quality, Growth, Longevity, and Price) philosophy, seeking out high-quality companies with strong growth prospects and attractive valuations.

Portfolio Construction

The fund portfolio is diversified across market capitalizations, including large-cap, mid-cap, and small-cap stocks. They also allocate a portion of the portfolio to IPOs and other primary market offerings that align with investment criteria.

Risk Management

While aiming for returns, the fund prioritizes safety, liquidity, and risk management. The goal is to strike a balance between generating returns and protecting investors’ investments.

Why Should You Invest in This Fund?

Here are some reasons to consider this fund:

Adapts to Economic Changes: The fund managers make strategic decisions based on the economy’s cycle, which could help protect your investment during tough times.

Potential for Higher Returns: I know you were looking for this point, so here it is. By investing in the right sectors at the right time, you might see better returns compared to regular funds that stick to one strategy.

Less Risk in Downturns: In tougher economic phases, the fund could shift to safer investments, helping reduce the chance of big losses.

Business Cycle Funds: A Comparison

As mentioned earlier, the Business Cycle Fund by Motilal Oswal was recently launched. Apart from that, there are a few more. Here is a comparison of them.

Blue - Motilal Oswal Business Cycle Fund

Yellow - ICICI Pru India Opp Fund

Green - HDFC Manufacturing Fund

Red - SBI Innovative Opportunities Fund

Expense Ratio: Represents the fees charged by the fund; lower is better to keep costs down

PE Ratio for a mutual fund: Indicates how much investors are paying for a company's earnings; lower is better for value investing.

Sharpe Ratio: Shows the risk-adjusted returns of a fund; higher is better for more returns per unit of risk.

Standard Deviation: Measures the volatility of a fund's returns; lower is better for less risk.

Final Verdict

If you are looking for the best risk-adjusted returns and can tolerate higher fees, Motilal Oswal Business Cycle Fund might be the best option. For lower-cost investments, HDFC Manufacturing Fund is a strong contender, although its performance may not be as robust.

Update on Sahasra Electronics IPO

Sadly, I am not allotted the SME IPO ☹️☹️☹️☹️. The war situation may impact the GMP and the listing price. If it does not list at a high premium, I will consider investing in the company through an open market.

Your view on quant business cycle fund?